Crude oil exports from Türkiye have maintained their downward trend during the first five months of 2024, established since the start of 2023. In its latest weekly report, shipbroker Banchero Costa said that “2023 has been another positive period for crude oil trade, despite the high oil prices and risks of economic recession. In Jan-Dec 2023, global crude oil loadings went up +4.7% y-o-y to 2186.8 mln tonnes, excluding all cabotage trade, according to vessels tracking data from Refinitiv. The positive trend continued in Jan-May 2024, when global loadings increased by +1.2% y-o-y to 930.8 mln t, from 919.8 mln t in the same period of 2023. Exports from the Arabian Gulf were down by -1.0% y-o-y to 366.3 mln t in Jan-May 2024, and accounted for 39.4% of global seaborne trade. Exports from Russian ports (including Kazakh crude) also declined by -1.1% y-o-y to 95.4 mln tonnes, or 10.3% of global trade. From the USA, exports increased by +2.7% y-o-y to 87.0 mln tonnes in Jan-May 2024. From South America, exports surged by +13.6% y-o-y to 72.9 mln t. From ASEAN exports surged by +24.6% y-o-y to 56.9 mln t”.

According to Banchero Costa, “in terms of demand, the top seaborne importer of crude oil in Jan-May 2024 was Mainland China, accounting for 23.0% of global trade. Volumes into China surged by +3.1% y-o-y to 213.4 mln t in Jan-May 2024, from 207.0 mln t in Jan-May 2023, and were above the record 203.0 mln t in Jan-May 2021. Imports to the EU27 increased by +1.3% y-o-y to 199.8 mln t, accounting for 21.5% of global trade. To ASEAN, imports increased by +11.1% y-o-y to 111.6 mln t. To India, volumes increased by +0.7% y-o-y to 99.6 mln t in Jan-May 2024”

The shipbroker said that “Türkiye is one of the largest exporters of crude oil outside the Arabian Gulf, and a major player in the Mediterranean oil market. This is so despite the fact that Türkiye does not have any significant domestic oil reserves. Instead, it is a major export outlet for crude from Azerbaijan and from Northern Iraq. The majority of crude shipped from Türkiye is Azeri BTC grade, sourced from the Baku-Tbilisi-Ceyhan pipeline. This is a 1768 kilometres long crude oil pipeline connecting the AzeriChirag-Gunashli oil field in the Caspian Sea to the Mediterranean Sea Coast. Most of the rest of Turkish exports is Kirkuk grade oil from Northern Iraq. Kirkuk oil is sourced from the 970 kilometres long Kirkuk-Ceyhan Oil Pipeline, also known as the IraqTürkiye Crude Oil Pipeline”.

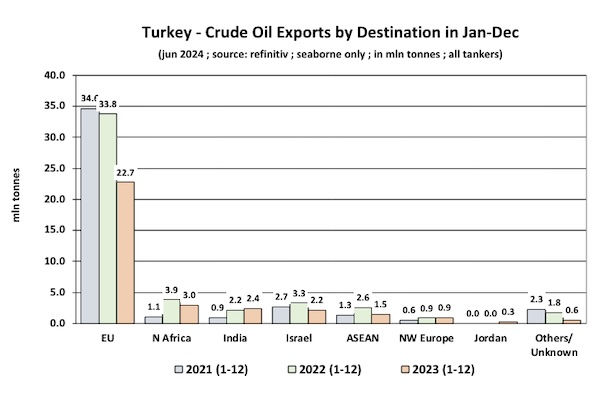

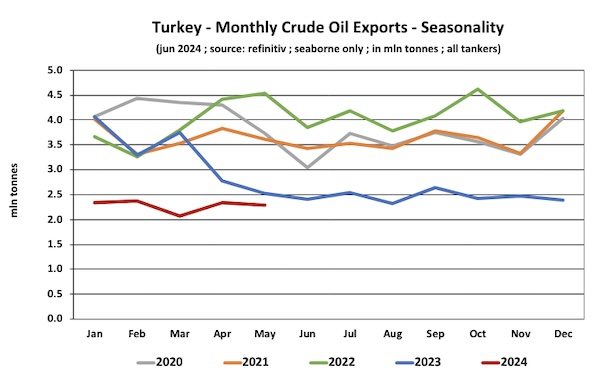

“Essentially all Turkish crude oil exports are loaded at the Ceyhan terminal. About 31% of volumes loaded in Jan-Dec 2023 was carried in Suezmaxes, and about 68% was loaded on Aframaxes. Of the 48.5 mln tonnes of crude oil shipped from Ceyhan in 2022, 29 mln tonnes arrived by pipeline from Azerbaijan, and 19 mln tonnes were from Kurdish areas in Northern Iraq In the 12 months of 2022, Turkish seaborne crude oil exports surged by +11.6% y-o-y to 48.5 mln tonnes, excluding cabotage, just below the 49.5 mln tonnes of 2019. In Jan-Dec 2023, however, exports from Türkiye declined by -30.6% y-oy to 33.6 mln t. Türkiye stopped oil flows through the pipeline from northern Iraq on the 25th of March. Officially, Türkiye began maintenance work on the pipeline, which, according to Turkish officials, passes through a seismically active area and was damaged by floods. In Jan-May 2024, Turkish exports were down -30.4% y-o-y to 11.4 mln t, from 16.4 mln t in Jan-May 2023. In terms of destinations for crude shipments from Türkiye, the EU27 is by far the top one, accounting for 68% of crude oil volumes exported from Türkiye in Jan-Dec 2023. In Jan-Dec 2023, Türkiye shipped 22.7 mln t to the EU27, -32.7% y-o-y. In Jan-May 2024, exports to the EU declined -30.4% y-o-y to 7.9 mln t from 11.4 mln t in Jan-May 2023”, Banchero Costa concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide